Questions you should research before hiring a business insurance agent abilene tx

Comprehending the Different Types and Utilizes of Insurance for Your Financial Protection

Insurance plays a crucial role in economic planning. It offers a safety web versus unforeseen occasions that can cause substantial monetary strain. Various kinds of insurance, such as health, life, and vehicle, address particular dangers that individuals face. Comprehending these alternatives is essential for producing a detailed method. What factors should one think about when examining their insurance needs? Exploring this inquiry can bring about far better monetary safety and security.

The Significance of Insurance in Financial Planning

Although numerous people overlook insurance as an essential aspect of financial planning, it functions as a basic safeguard against unpredicted occasions. Insurance supplies a security web that safeguards people and families from monetary difficulty brought on by accidents, natural catastrophes, or unexpected losses. By incorporating various kinds of insurance, such as building, life, and special needs coverage, individuals can mitigate threats and guarantee monetary security

Insurance can play a crucial role in wealth conservation. It permits insurance holders to allocate their resources much more properly, recognizing they are secured against considerable obligations. This financial protection cultivates comfort, encouraging individuals to seek their objectives without the continuous fear of prospective troubles. Eventually, recognizing the importance of insurance within a comprehensive financial plan makes it possible for people to construct resilience against life's unpredictabilities, ensuring long-lasting safety and security and health on their own and their liked ones.

Medical Insurance: Securing Your Wellness

Medical insurance is an essential element of an individual's overall monetary method, straight impacting their health. It provides monetary security versus high medical prices, ensuring accessibility to needed medical care solutions. With unexpected diseases or accidents, having medical insurance can ease the concern of costs associated with hospital remains, surgical treatments, and treatments.

In addition, it advertises precautionary treatment by covering regular exams and testings, which can cause early discovery of health and wellness problems. This aggressive strategy not only improves specific health however can also result in lower long-term health care expenses.

Wellness insurance can vary widely in coverage, so comprehending different strategies permits people to select one that finest fits their demands and budget. By buying appropriate medical insurance, individuals protect their economic security while prioritizing their health and wellness, inevitably fostering a complacency and assurance.

Life Insurance: Safeguarding Your Household's Future

Life insurance policy plays a vital role in guaranteeing monetary stability for family members in case of an untimely loss. Numerous kinds of life insurance, such as term and entire life policies, use different benefits tailored to the needs of loved ones. Understanding these choices can aid people make notified decisions to secure their family members's future.

Kinds of Life Insurance

Maneuvering the landscape of life insurance can be frightening, yet comprehending its numerous types is important for securing a family members's economic future. The key categories consist of term life insurance policy, whole life insurance, and global life insurance. Term life insurance policy supplies protection for a specific duration, commonly 10 to three decades, making it a cost-effective alternative for several family members. Entire life insurance uses lifelong coverage with a cost savings part, allowing insurance holders to collect cash money worth over time. Universal life insurance combines versatility with investment opportunities, enabling adjustments in premiums and survivor benefit. Each type offers distinctive purposes, dealing with private demands and financial objectives, making it important for individuals to examine their situations prior to choosing the suitable life insurance policy plan.

Benefits for Loved Ones

Selecting the ideal life insurance coverage policy can significantly influence the monetary health of enjoyed ones in the occasion of an unfortunate death. Life insurance supplies a safety and security web, guaranteeing that recipients can maintain their standard of living in spite of the loss of the main revenue earner. The survivor benefit can cover essential costs, such as home mortgage repayments, education prices, and everyday living costs, alleviating financial tension during a difficult time. In addition, it can help work out financial debts and funeral prices, stopping enjoyed ones from facing monetary problems. By safeguarding a plan, people not just shield their family's future however additionally leave a tradition of care and duty, allowing their liked ones to focus on recovery as opposed to monetary instability.

Auto Insurance: Insurance Coverage for Your Vehicles

Auto insurance is vital for lorry owners, this link supplying economic defense versus potential losses from accidents, burglary, and other unpredicted occasions. This sort of insurance normally includes a number of insurance coverage choices, such as obligation, crash, and thorough protection. Obligation insurance coverage safeguards against problems to other celebrations if the insured is at fault in a crash, while accident protection compensates for problems to the insured car. Extensive insurance coverage addresses non-collision-related occurrences, including theft and all-natural disasters.

Car insurance frequently includes without insurance and underinsured driver protection, which safeguards the guaranteed in case of mishaps including chauffeurs lacking sufficient insurance. Premiums can differ based on many aspects, including driving history, car kind, and location. By selecting proper protection degrees and understanding plan terms, lorry owners can guarantee they are effectively secured, thus adding to their general economic protection.

House Owners Insurance: Guarding Your Residential property

Home owners insurance plays an essential duty in safeguarding houses versus different threats. This coverage normally consists of defense for the dwelling, personal residential or commercial property, and obligation, to name a few elements - car insurance company abilene tx. Understanding the sorts of protection readily available and the insurance claims procedure is crucial for home owners to properly guard their financial investments

Insurance Coverage Types Explained

An extensive understanding of insurance coverage kinds is important for anybody aiming to guard their home properly. House owners insurance generally includes several essential coverage categories. Residence coverage shields the physical framework of the home versus damages from particular threats, such as fire or criminal damage. Personal effects coverage safeguards valuables inside the home, including furnishings, electronics, and clothing. Liability insurance coverage uses financial protection in case of injury to others on the property or damage triggered by homeowners. Extra living expenditures coverage assists with costs sustained if the home ends up being unliveable because of a protected event. Recognizing these various sorts of coverage allows house owners to choose a plan that aligns with their requirements, ensuring substantial security for their most beneficial property.

Claim Process Summary

Steering the case process for house owners insurance is vital for ensuring prompt and ample payment after a loss. The process typically begins with notifying the insurance supplier of the occurrence, adhered to by an analysis of the problems. Home owners ought to document the loss completely, taking photographs and maintaining receipts to support their insurance claim. After submitting the insurance special info claim, an insurer will assess the situation, establishing the level of insurance coverage appropriate. Effective interaction with the insurance provider is essential, as it can accelerate the procedure. Homeowners need to additionally review their policy to comprehend their legal rights and responsibilities. Inevitably, navigating the case process effectively can lead to a smoother experience and an adequate resolution for homeowner dealing with unanticipated obstacles.

Disability Insurance: Earnings Protection When You Need It A lot of

Disability insurance typically drops right into 2 categories: short-term and long-lasting. Temporary special needs insurance uses insurance coverage for a limited period, generally as much as 6 months, while long-lasting special needs insurance can prolong for numerous years or till old age.

Eligibility for advantages frequently depends upon the severity of the handicap and the policy terms. It is important for individuals to assess their demands and choose a plan that lines up with their financial situation. By securing disability insurance, individuals can preserve their top quality of life and emphasis on healing, lowering the anxiety associated with economic instability.

Specialized Insurance: Unique Coverage Options for Certain Demands

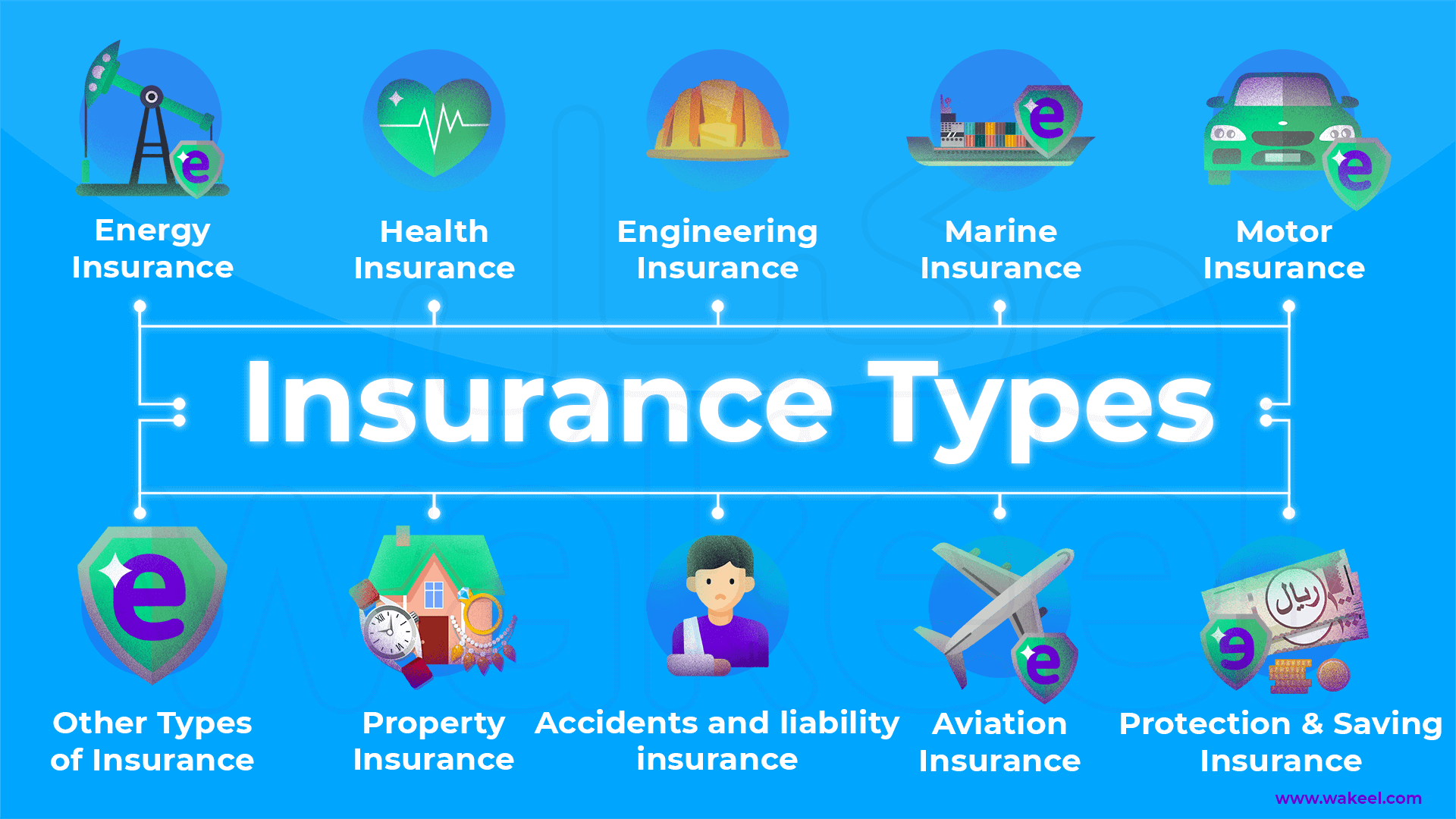

Specialized insurance provides tailored protection for one-of-a-kind scenarios that basic plans commonly forget, attending to the varied demands of people and companies. This sort of insurance incorporates a variety of products made for particular dangers, such as pet dog insurance, event cancellation insurance, and expert liability protection for niche sectors.

For example, a professional digital photographer may require protection for tools damages or liability pertaining to their work, while a little business organizing a significant occasion could seek protection against unpredicted cancellations. Additionally, high-net-worth individuals might go with specialty insurance to secure valuable properties such as art collections or unusual lorries.

Often Asked Inquiries

What Elements Determine My Insurance Costs?

Insurance premiums are affected by numerous aspects including age, health and wellness standing, place, coverage amount, declares history, and the sort of insurance. Each element adds to the overall danger analysis carried out by insurers.

Exactly How Can I Reduced My Insurance Expenses?

To reduced insurance expenses, people may think about increasing deductibles, bundling policies, maintaining a good credit rating, look at this website benefiting from discounts, and consistently assessing coverage to get rid of unneeded options, eventually bring about lowered costs.

What Is the Distinction In Between Term and Whole Life Insurance Policy?

The distinction between term and whole life insurance hinges on period and benefits. Term insurance supplies coverage for a specified duration, while whole life insurance policy uses long-lasting defense with a money worth component, accumulating with time.

Do I Required Insurance for Rental Properties?

The need of insurance for rental residential properties relies on various factors, consisting of prospective liabilities and monetary threats (car insurance agent abilene tx). Landlords usually select protection to secure versus problems, loss of earnings, or legal insurance claims occurring from lessee problems

What Should I Do if My Case Is Rejected?

When an insurance claim is denied, one ought to examine the rejection letter, collect necessary paperwork, speak to the insurer for information, and consider appealing the decision or seeking lawful recommendations if needed.